by Joe | Jun 26, 2025 | News and Articles

When it comes to financing multifamily properties, not all loans are created equal. For real estate investors, especially those focused on building scalable portfolios, a DSCR loan (Debt Service Coverage Ratio loan) offers unique advantages over traditional...

by Joe | Jun 19, 2025 | News and Articles

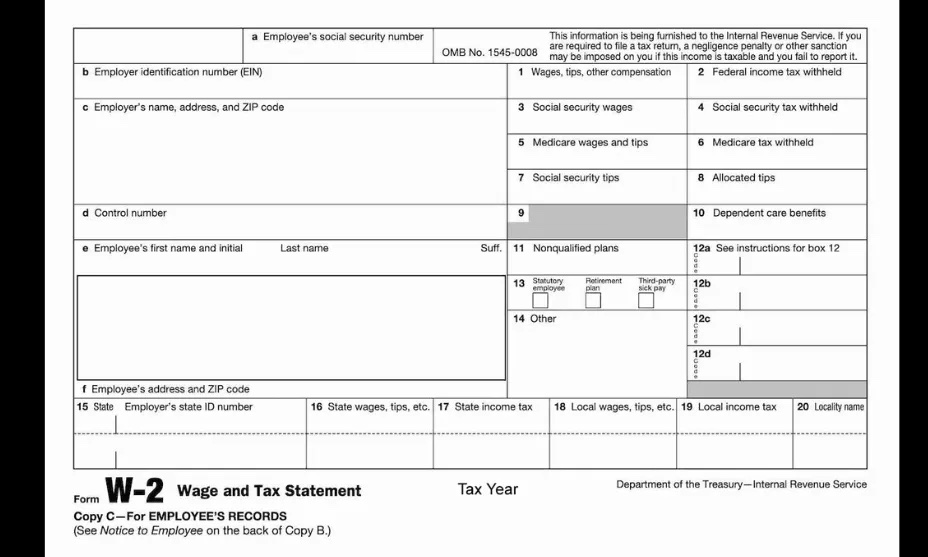

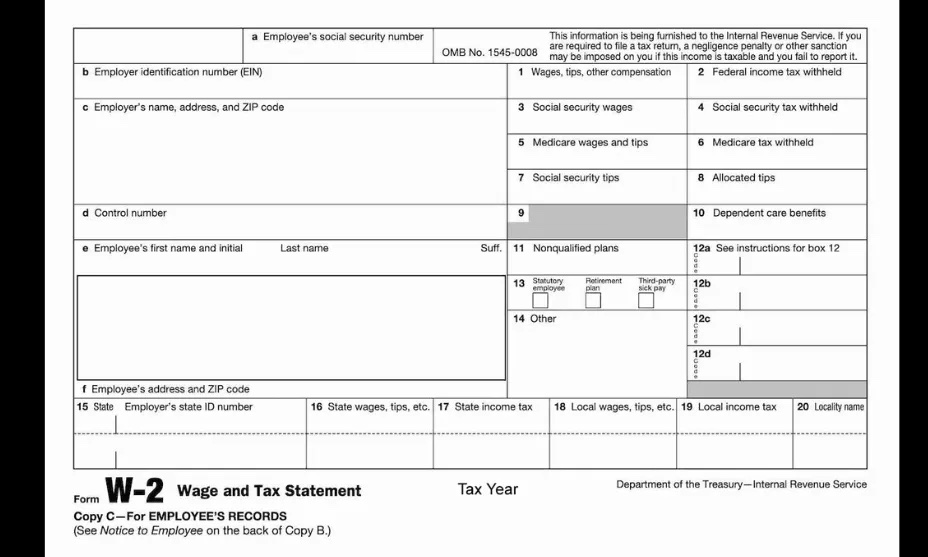

If you’re self-employed, a real estate investor, or someone who doesn’t earn a traditional paycheck, you’ve probably run into the same frustrating wall: banks don’t understand your income. Maybe your business writes off too much. Maybe you have a dozen rentals...

by Joe | Jun 19, 2025 | News and Articles

When timing is everything, and a traditional lender is dragging its feet, investors turn to bridge loans—and for good reason. Whether you’re buying a flip, closing fast on an off-market deal, or just need temporary capital while arranging long-term financing, bridge...

by Joe | Jun 19, 2025 | News and Articles

When you’re building a rental portfolio, traditional lending can feel like a dead end. Banks want W-2s, tax returns, and a squeaky-clean DTI—none of which reflect the real strength of your deals. That’s where DSCR loans come in. DSCR stands for Debt Service...