Articles & News

Stay sharp with tips, tools, and updates from the Happy Funds team. From loan hacks to market insights, our articles keep investors in the know and ahead of the game.

Why Real Estate Investors Choose DSCR Loans for Multifamily Properties

When it comes to financing multifamily properties, not all loans are created equal. For real estate investors, especially those focused on building scalable portfolios, a DSCR loan (Debt Service Coverage Ratio loan) offers unique advantages over traditional...

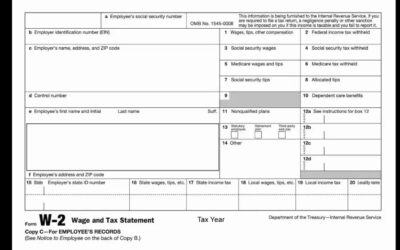

No-Doc Loans: The Easiest Way to Fund Deals Without Tax Returns

If you're self-employed, a real estate investor, or someone who doesn’t earn a traditional paycheck, you’ve probably run into the same frustrating wall: banks don’t understand your income. Maybe your business writes off too much. Maybe you have a dozen rentals but no...

Bridge Loans: The Fast Lane for Real Estate Investors

When timing is everything, and a traditional lender is dragging its feet, investors turn to bridge loans—and for good reason. Whether you’re buying a flip, closing fast on an off-market deal, or just need temporary capital while arranging long-term financing, bridge...

Why DSCR Loans Are a Game-Changer for Real Estate Investors

When you're building a rental portfolio, traditional lending can feel like a dead end. Banks want W-2s, tax returns, and a squeaky-clean DTI—none of which reflect the real strength of your deals. That’s where DSCR loans come in. DSCR stands for Debt Service Coverage...

Start Funding Today

Ready to make your next move? Send us your deal and let’s get you funded—fast, simple, and stress-free. Your next opportunity starts with Happy Funds.