If you’re self-employed, a real estate investor, or someone who doesn’t earn a traditional paycheck, you’ve probably run into the same frustrating wall: banks don’t understand your income. Maybe your business writes off too much. Maybe you have a dozen rentals but no “day job.” Whatever the case, the bank says no—not because the deal is bad, but because the paperwork doesn’t fit their box.

That’s where No-Doc loans come in.

At Happy Funds, we offer No-Doc loan programs built specifically for people like you—buyers with strong assets, great strategies, and non-traditional income.

What Is a No-Doc Loan?

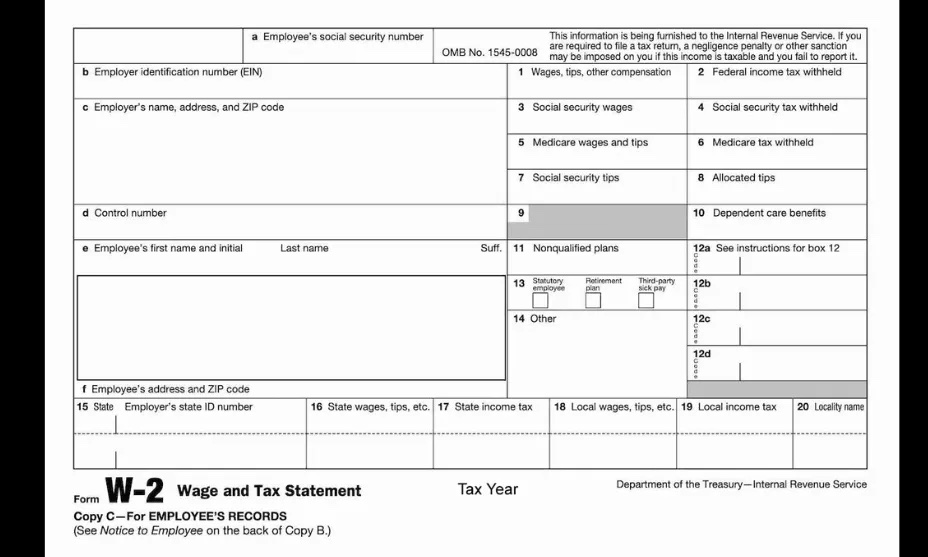

A No-Doc (no documentation) loan is a mortgage that requires little to no verification of traditional income documents. That means no tax returns, no W-2s, no pay stubs. Instead, approval is based on your credit, assets, and the property itself.

In most cases, if you have decent credit and a solid down payment, you’re good to go.

No-Doc loans are part of the broader Non-QM (non-qualified mortgage) world, which exists to serve borrowers outside the conventional mold—especially investors and entrepreneurs.

Why No-Doc Loans Are a Game-Changer

1. No Income Verification

Skip the W-2s, tax returns, and explanations. If the property and your credit meet the guidelines, you’re approved—simple as that.

2. Perfect for Self-Employed Buyers

Freelancers, business owners, gig workers, and 1099 earners finally have a way to get financed without trying to “look good on paper.”

3. Investor-Friendly

Own 5, 10, or 50 rentals? No-doc loans let you keep growing without being capped by DTI limits or portfolio restrictions.

4. Fast Closings

With less documentation to verify, the process moves quickly—often closing in 2–3 weeks or less.

5. Close in an LLC

Most no-doc lenders (like Happy Funds) allow you to buy in your entity, keeping your investments protected and well-structured.

Real-World Example

You’ve got $60K in the bank and want to buy a $300K short-term rental. You’ve got great credit, a strong track record, but no verifiable income due to business write-offs.

A traditional lender won’t touch it. A No-Doc loan from Happy Funds will.

Things to Know About No-Doc Loans

- Down Payments: Typically 20–30%

- Rates: Slightly higher than conventional loans

- Minimum Credit Score: Usually 660+

- No DTI Calculations: Your personal income doesn’t factor in

- Ideal for: Rentals, second homes, flips, and short-term rental investments

Who Should Use a No-Doc Loan?

- Self-employed buyers or business owners

- Real estate investors scaling up

- Buyers with strong assets but low reported income

- First-time investors without traditional income

- Anyone sick of explaining their tax returns to a loan officer

The Bottom Line

No-Doc loans exist because not all smart borrowers look good on paper. If you’ve got the down payment, credit, and a solid deal, there’s no reason to let a lack of documents stop you. At Happy Funds, we believe in funding real people—not just bank statements.

Have a deal you want us to look at?

Let’s get it funded—fast, simple, and with no paperwork headaches.